Bearish Signals in Stocks – July 9, 2025

Apollo Hospitals

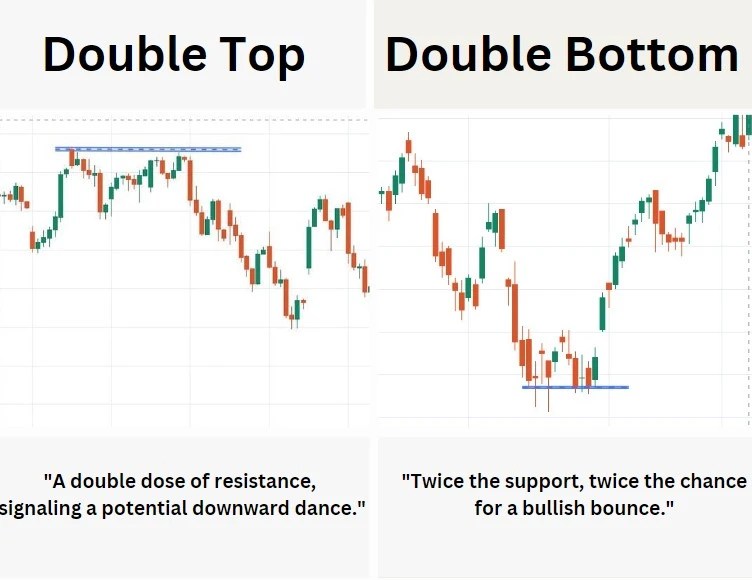

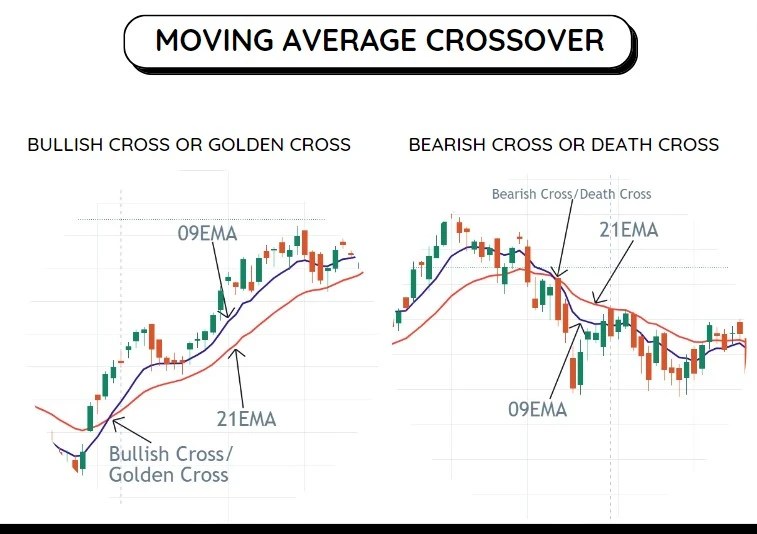

Apollo Hospitals has formed a bearish inside bar, indicating indecision and a possible reversal. A confirmation candle was formed today, suggesting the sellers may take control. Watch closely for further downside movement if support breaks.

Gail

Gail has created a bearish hammer which has now been completed and confirmed by a red Morubozu candle. The price has closed below all key moving averages – 9, 21, 50, and 200 DEMA, indicating strong downward pressure. This is a serious bearish sign for short-term traders.

Siemens

Siemens follows a similar pattern to Gail. A bearish hammer was confirmed by a red Morubozu, and prices have closed below the 9, 21, 50, and 200 DEMA, signaling a potential trend reversal and weakness ahead.

MaxHealth

MaxHealth is showing a strong bearish setup. The stock has formed three continuous red candles at the top, followed by a long red Morubozu candle. What makes it more alarming is the increasing volume, confirming heavy selling pressure. This pattern indicates that buyers are losing strength.

IOC (Indian Oil Corporation)

IOC has formed an evening star type pattern, but with a twist – the middle candle resembles a half-bodied hanging man, making it a mixed signal. Still, traders should remain cautious as the formation points toward a possible bearish trend if confirmed.

Bullish Signal: Chola Finance Shows Strength

Chola Finance bucks the trend with a bullish hammer formed in the last session. Today, the pattern was confirmed with a strong green Morubozu candle, showing renewed buying interest. This setup suggests a possible upside in the coming sessions, especially if volumes support the move.

Conclusion: Mixed Signals, Traders Must Stay Alert

The overall market tone today is more bearish than bullish, with key stocks like Apollo, Gail, Siemens, and MaxHealth giving strong reversal signals. However, Chola Finance stands out with a positive pattern, offering hope for bulls.

Important Note: All technical patterns mentioned are based on daily charts as of July 9, 2025. Traders should wait for further confirmation before taking any position and must use proper risk management. Read our disclaimer before betting on a trade based on this article.

Leave a comment