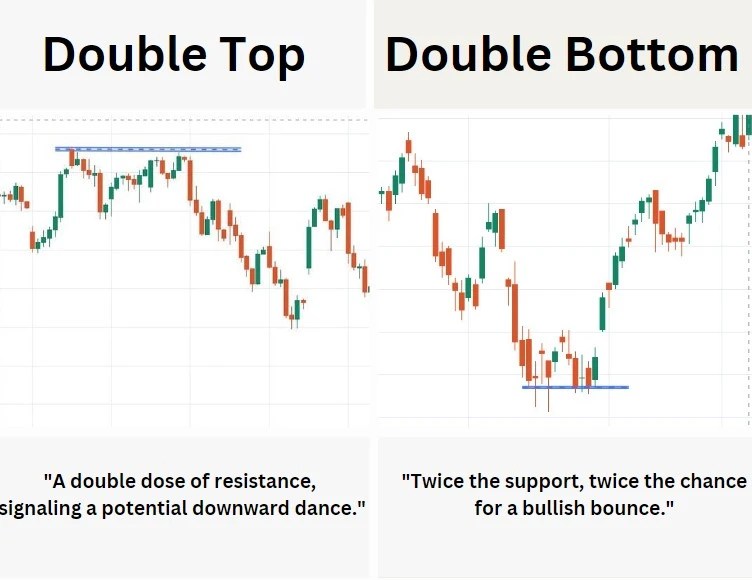

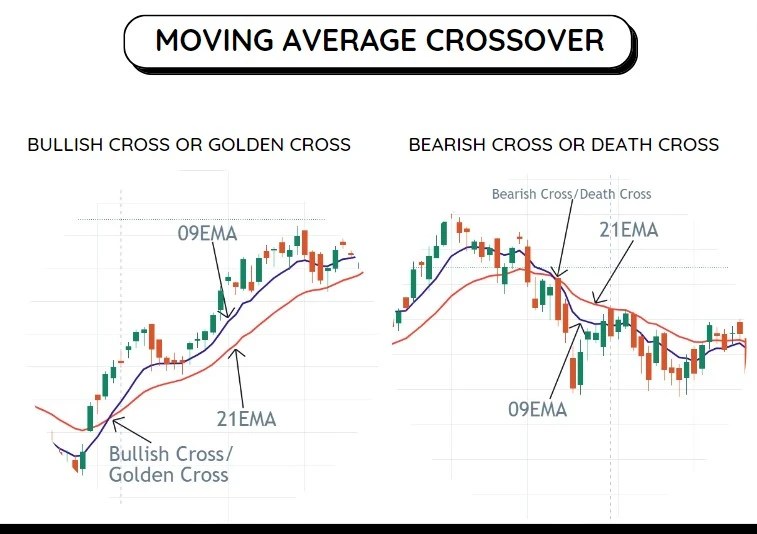

Tube Investments of India (TIINDIA) has just printed a textbook bullish kicker marubozu pattern — a two-candlestick setup where a bearish candlestick is immediately followed by a bullish one that gaps higher.

This signals a dramatic shift from seller domination to aggressive buying, and such rare candles often mark the start of a strong upward move.

Fundamentals & Catalyst News

- Q4 FY25 results (reported mid-May) show a 14.7% YoY rise in consolidated sales to ₹5,150 Cr, although standalone sales dipped slightly.

- Clean financials: interest costs are under 1% of sales, with ~9% in employee expenses.

- Dividend of ₹1.50 per share declared (record date: July 25, 2025) reflects strong cash flows.

- The investor meet was held on June 20, indicating proactive management engagement.

Why This Kickoff Matters

The bullish kicker pattern likely reflects market reaction to strong sales, clean margins, and shareholder-friendly payouts. With solid fundamentals and improving auto-sector sentiment, the technical signal echoes the fundamental story.

Quicktake: What This Means for Traders & Investors

- Short-term traders might enter on the breakout above the kicker’s high, placing a stop just below the marubozu low — a classic entry with defined risk.

- Long-term investors get confirmation of both bullish technical momentum and stable business performance (low debt, rising revenues, dividends).

What Comes Next?

- Watch for follow-through price action and volume — sustained gains would confirm the trend shift.

- Q1 FY26 results (likely July 31) will be key — any upside surprise could add fuel.

- Keep tabs on Auto & EV supply chain updates, since TIINDIA is pivoting into EV components via Murugappa’s EV arm.

- Trading stop loss can be kept below 2825 to secure the capital.

TIINDIA now stands at a crucial inflection point — a breakout confirmed by rare candlestick action and backed by solid fundamentals. Whether you’re a momentum trader or a long-term investor, this is a setup worth watching closely.

Note: We are not SEBI registered advisors, read our disclaimer before making an entry based on this article.

Leave a comment